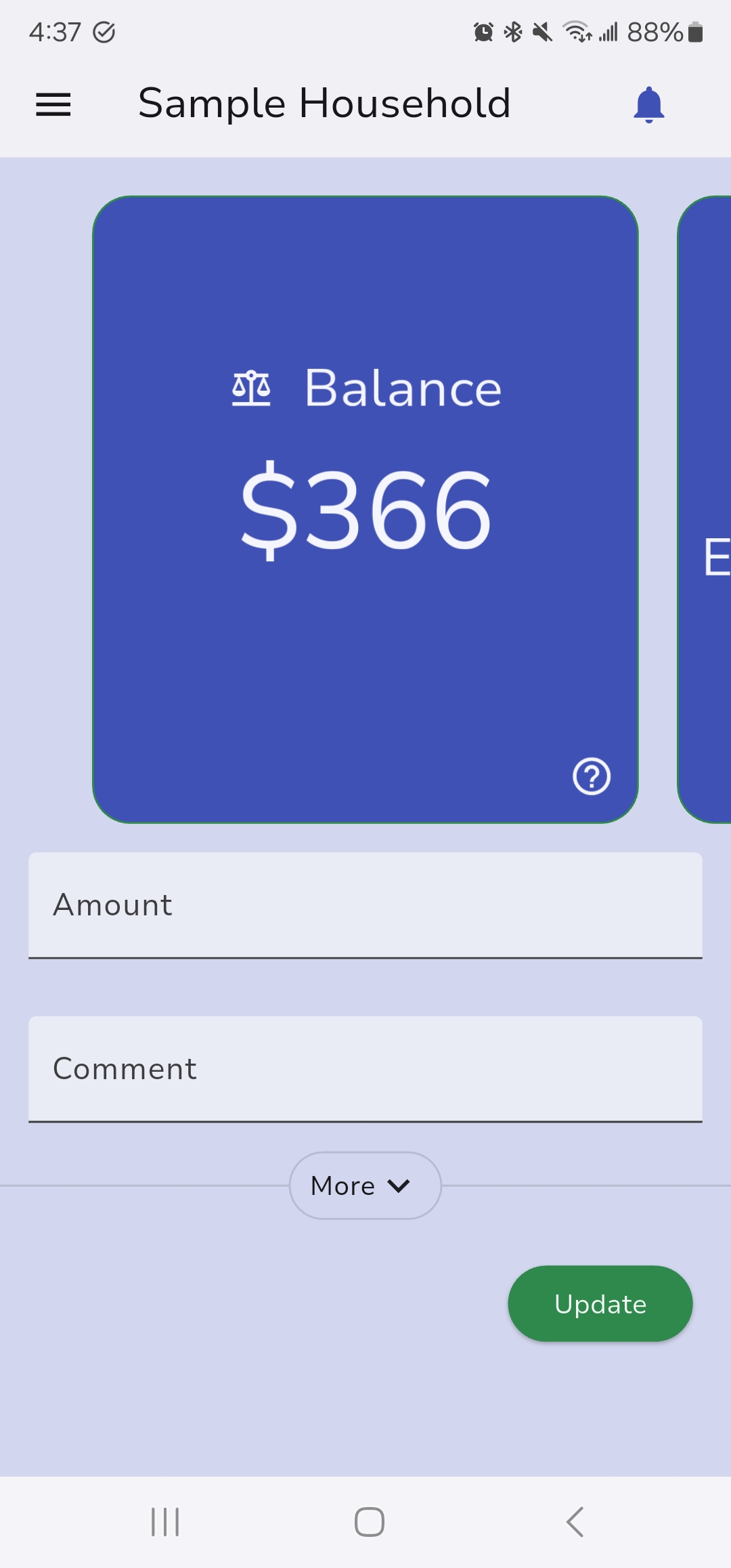

This is where you'll interact most with your finances. The "Balance" screen lets you report income or expenses as they happen and always know your current financial standing.

Themis Balance is designed to give you a clear view of your actual available funds – the money you can really spend or save. To keep this "weekly balance" accurate, you should aim to report any financial transaction, big or small, that affects this spendable amount. This includes:

Essentially, if money has moved, whether it's via cash, card, or any other mean, a quick update in Themis Balance ensures your shared financial picture stays clear. And remember our 'No Cents' philosophy - just round to the nearest whole number to keep things quick and simple!

Note that regular income or expenses (such as salary, rent or mortgage) can be automated during the onboarding screens or via the "Weekly Budget" screen.

As an example, let's say you and your friend grabbed coffee together but your friend forgot (or "forgot", we don't judge) their wallet at home, so you paid $60 cash for the both of you. Later that day, your friend made an eTransfer of $25 to your bank account. If you already got into the habit of reporting everything to Themis balance there should be a $-60 transaction (perhaps with a comment "to be refunded") and a $25 later. However, if you only remembered that in the evening you could add a transaction of $-35. Really up to you, just consider that detailed updates makes it easier to understand what happened later when you look at the "History" screen

Keeping your balance regularly updated means Themis Balance can provide the most accurate reflection of your current financial flow. This allows you and your household to:

At the top, you'll see a carousel of three informative cards. You can swipe left or right to view each one, and each card can be flipped for more details.

This card offers a different, more dynamic way to view your financial status. Here's the idea: instead of your Weekly Budget amount arriving as a lump sum once a week (as reflected in Card 1), the Continuous Balance card *spreads that weekly budget evenly across every second of the week*. So, with every passing second, this balance very slightly increases.

Why is this useful? It gives you an extremely precise, real-time understanding of your spending relative to your weekly flow. If Card 1 shows $100 left, that might be great if your weekly budget is about to hit, but concerning if it just did. The Continuous Balance helps normalize this by showing you a constantly adjusting "true" position.

Important Note: This is an advanced concept! Many users find Card 1 (Current Balance) perfectly straightforward and sufficient for their needs. It's absolutely fine to primarily use the first card. The Continuous Balance is there if you want a more granular view, but don't feel pressured to use it if the first card makes more sense to you.

Flip Side: If the continuous balance is negative, shows the estimated time when will it break even. Otherwise, it means you're doing great! it'll show an inspirational quote.

Below the main input area, a "More" control reveals some advanced options: