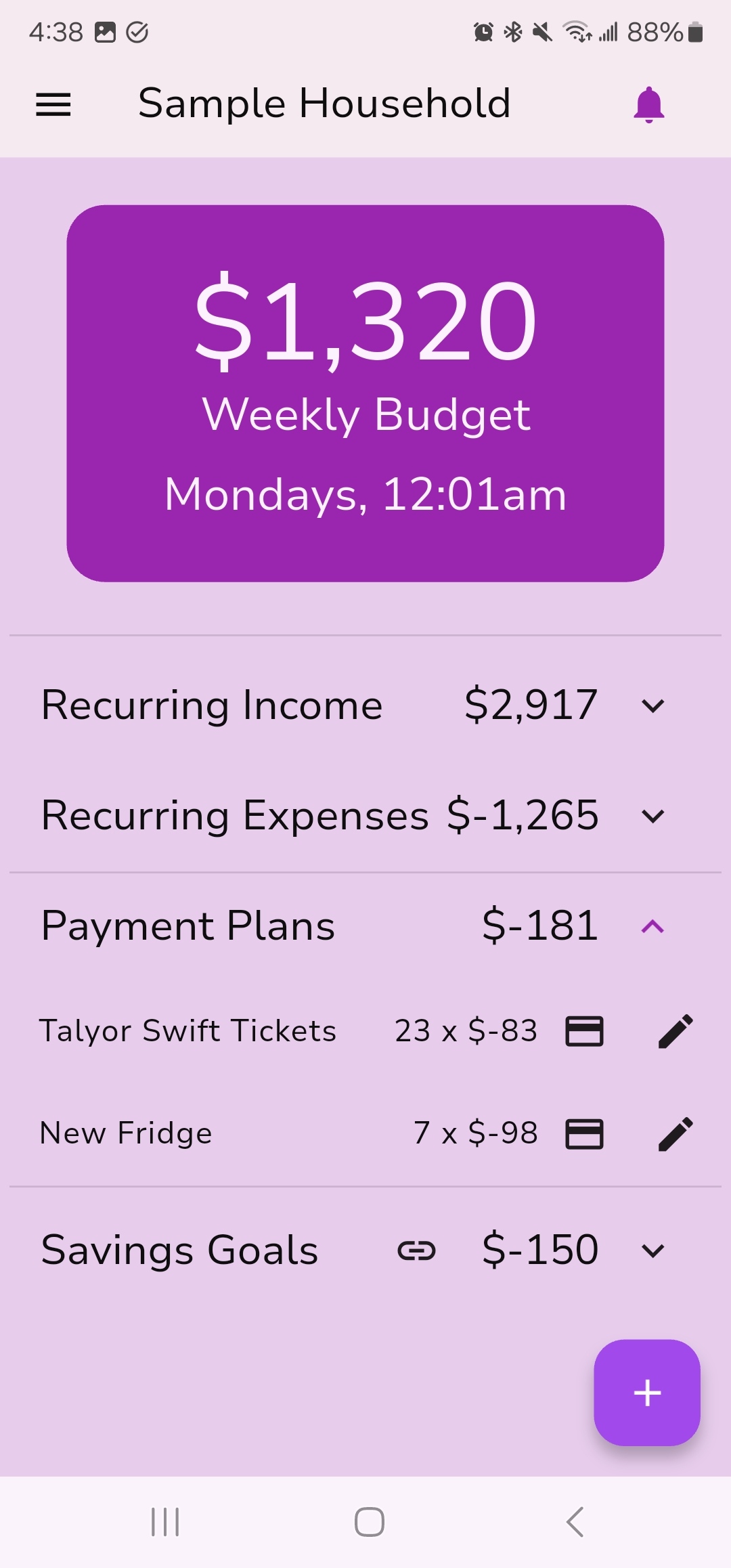

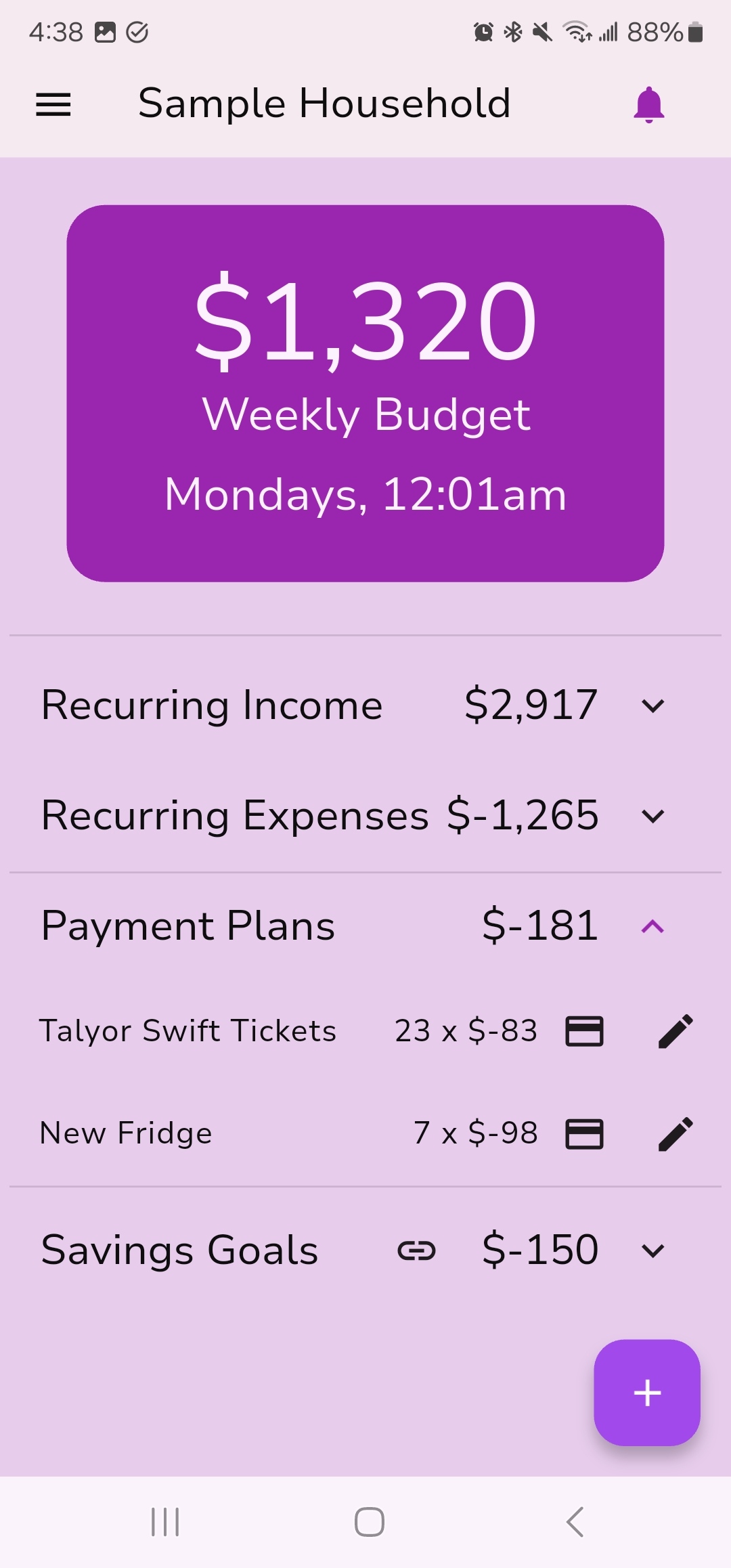

The "Weekly Budget" Screen: Your Predictable Flow

Usually you have incomes or expenses that takes place on a semi-monthly, monthly or even yearly cadence. Making these updates when they happen causes large swings in your balance that makes it difficult to understand how much money you have on-hand. You need to keep track of what is going to happen next week.

The "Weekly Budget" screen streamline your predictable changes, making their impact weekly. Instead of spending the entire rent once every 4 weeks (say, 2000 a month), this screen divides the impact by reducing the balance by 500 every week.

- Net Weekly Amount: At the top, you'll see the total net amount that will adjust your balance each week. This is usually an increase (if income outweighs expenses) but could be a decrease.

- Update Schedule: Below the net amount, it shows when this weekly budget adjustment happens (e.g., "Saturdays at 12:01 am"). The time (12:01 am) is fixed, but you can change the day of the week in the "Settings" screen.

- Transaction Sections: Your regular transactions are organized into four clear sections:

- Recurring Income: Regular transactions where the amount is positive (e.g., salary).

- Recurring Expenses: Regular transactions where the amount is negative (e.g., rent, mortgage, subscriptions).

- Payment Plans: This section lists any ongoing plans you set up from the "Balance" screen (using the "Payment Plan" advanced feature). These typically reduce your net weekly budget amount.

- Saving Goals: If you've set up any "Savings Goals" with weekly deposits (see next screen), those deductions will appear here, also reducing your net weekly budget amount but contributing to your savings.